ohio sales tax exemption form reasons

You will need to state a reason for the exemption which would be that the item is being purchased to be used in the manufacturing of tangible personal property for sale. Taxable sales include all transactions in which one entity transfers possession of tangible property or a title to property to another entity for a price.

Ohio Sales Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

. The buyer must specify which one of the reasons for exemption on the certificate applies. Exemption certificate forms A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. Use tax must be paid on all purchases made by Ohio residents and businesses if the proper amount of sales tax has not been paid to the vendor seller or service provider.

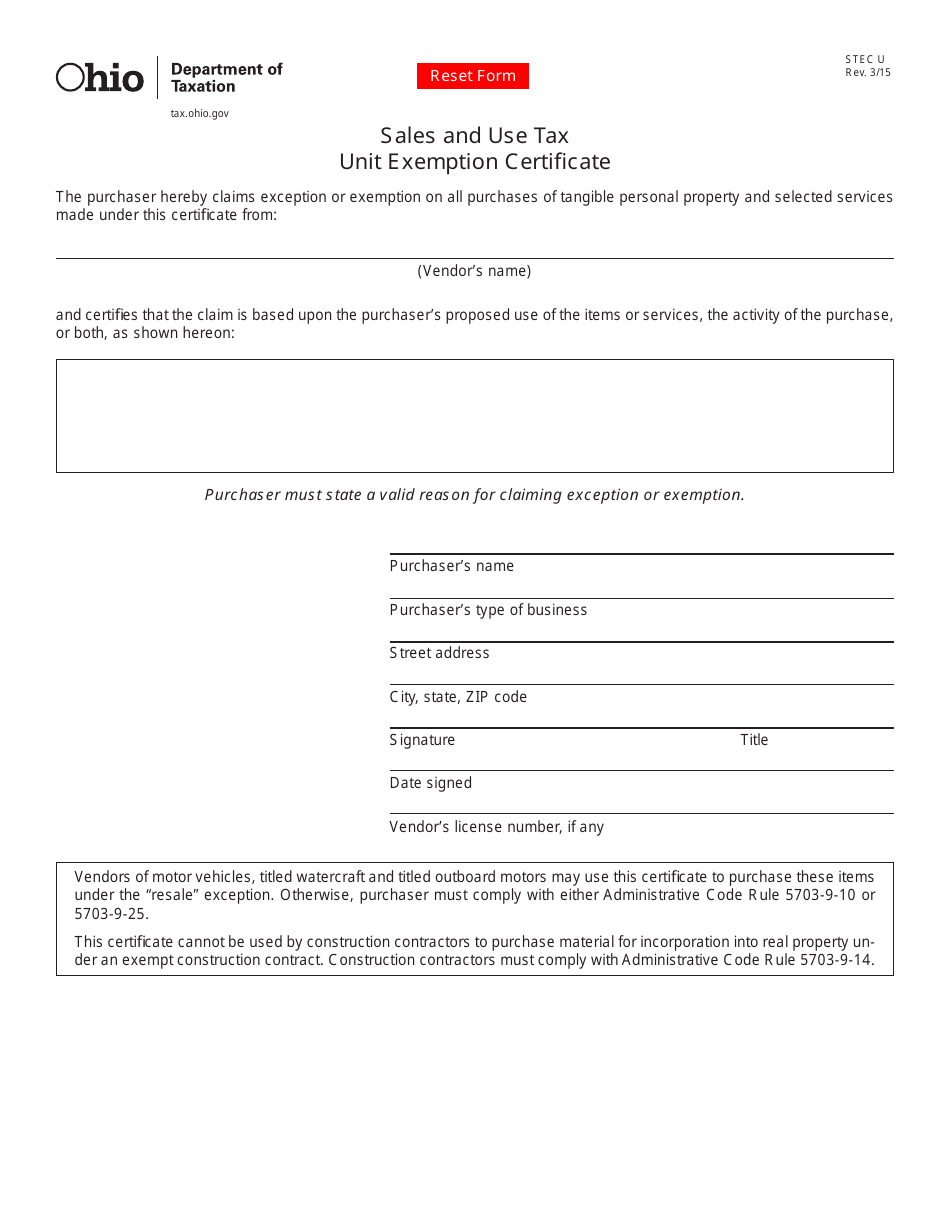

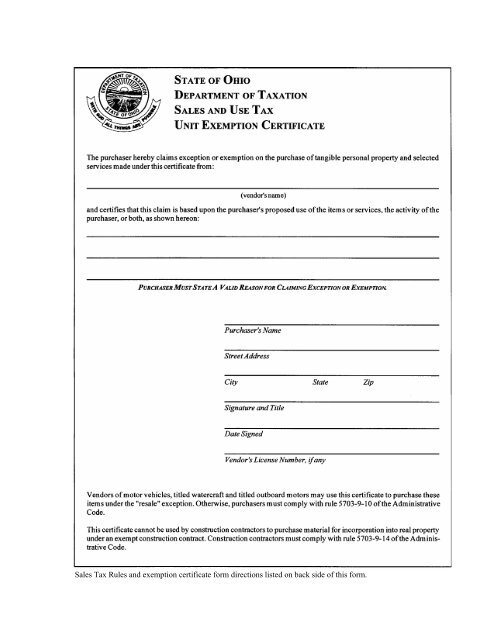

1 if a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming exemption from the sales and use tax based on a reason other than resale the vendor seller or consumer must comply with rule 5703-9-10 or 5703-9-25 of. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one. Those are the reasons for our newest law bulletin Ohios Agricultural Sales Tax Exemption Laws.

What is Ohio State tax. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce tangible personal property for sale. On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement.

Purchases that are properly exempt from sales tax are also exempt from the use tax. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock.

Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of the Revised Code. Unless Ohio tax code exempts them all retail sales are subject to sales and use tax. Sales tax can be scary especially when youre just starting your business.

Exempt Items Sales of certain items are exempt from sales and use tax. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Step 3 Describe the reason for claiming the sales tax exemption.

One of the main reasons for the use tax is to protect Ohio vendors from unfair. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. Its a hidden cost.

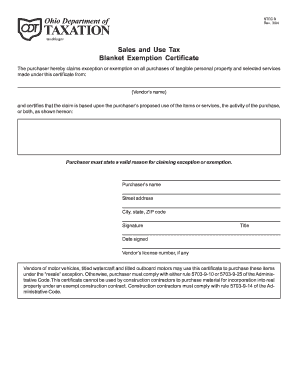

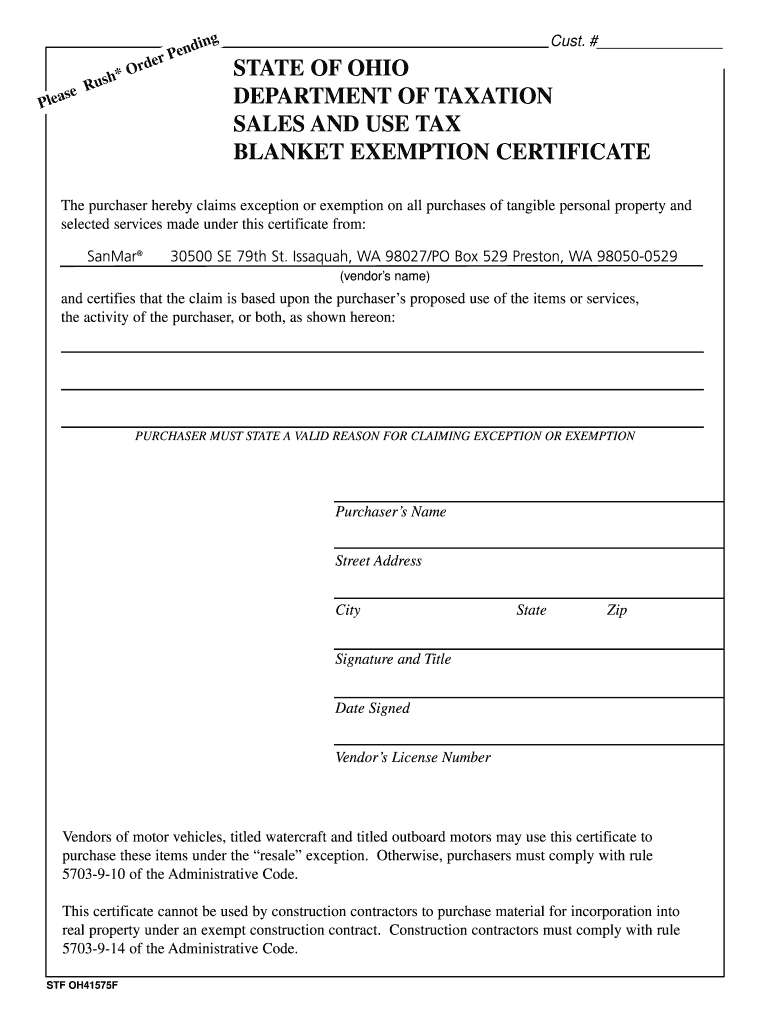

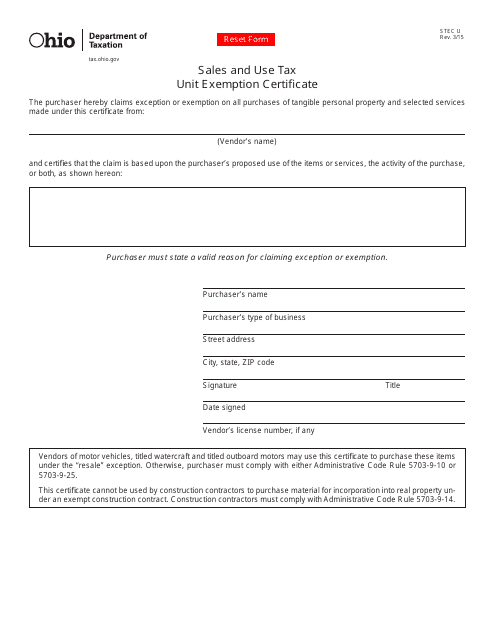

In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer. The blanket certificate exempts all purchases from sales tax for that vendor so use this form carefully if you purchase taxable items from the same vendor. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Thats because Ohios sales tax law is a bit tedious and complicated. Step 2 Enter the vendors name.

An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. Ohio Sales Tax Exemption Form. Ohio Revenue Code Ann.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. If unsure on whether to claim sales tax exemption this article on Ohio sales tax exemption and reasons to apply is what you need. Failure to specify the exemption reason will on audit result in disallowance of the certificate.

Sales and use tax. How to fill out the Ohio Sales and Use Tax Exemption Certificate. The state sales and use tax rate is 575 percent.

The law has several agricultural exemptions but it can be challenging to understand who can claim them and what types of goods and services are exempt.

Fill In Blank Tax Exemption Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

Ohio Tax Exempt Form Holland Computers Inc

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Farm Bag Supply Supplier Of Agricultural Film

Printable Ohio Sales Tax Exemption Certificates

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online